Westpac ASX vs. SEA Stock: Which One Is a Better Long-Term Bet?

Westpac ASX vs. SEA Stock: Which One Is a Better Long-Term Bet? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality.

The comparison between Westpac ASX and SEA Stock delves into their historical performance, financial health, market positioning, growth prospects, risk factors, and more.

Introduction to Westpac ASX and SEA Stock

Westpac ASX and SEA Stock are two prominent stocks in the financial market that attract investors looking for long-term opportunities. Westpac Banking Corporation, listed on the Australian Securities Exchange (ASX), is a leading financial institution in Australia, offering a wide range of banking and financial services.

On the other hand, Sea Limited, trading as SEA Stock on the New York Stock Exchange, operates as a digital entertainment and e-commerce company in the Southeast Asian region.

Westpac ASX

Westpac ASX is a key player in the banking industry in Australia, providing services such as retail banking, wealth management, and institutional banking. With a strong presence in the Australian market, Westpac ASX has a significant impact on the country's financial sector and economy.

SEA Stock

SEA Stock represents Sea Limited, a company that operates digital entertainment, e-commerce, and digital financial services in Southeast Asia. With a focus on innovative technology and expanding its market reach, SEA Stock has become a major player in the digital economy of the region.

Historical Performance Comparison

When comparing the historical performance of Westpac ASX and SEA Stock, it is essential to analyze their trends in stock prices over the past few years and identify any major events that influenced their performance.

Westpac ASX

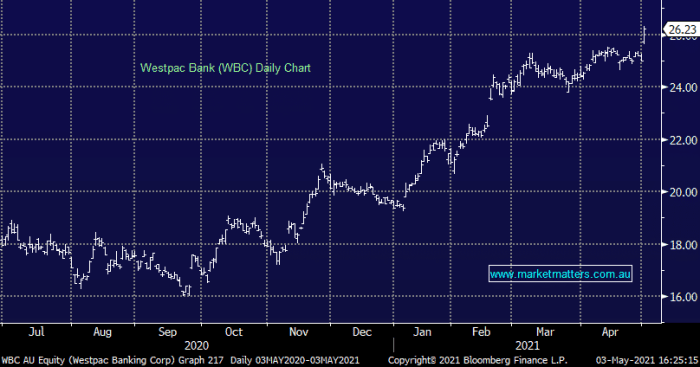

Westpac Banking Corporation, listed on the Australian Stock Exchange (ASX), has shown a somewhat stable performance over the years. Despite facing challenges in the banking sector and economic fluctuations, Westpac has managed to maintain its position as one of the leading banks in Australia.

The stock price of Westpac ASX has experienced fluctuations in line with market trends and regulatory changes affecting the banking industry.

SEA Stock

On the other hand, SEA Limited, listed on the New York Stock Exchange (NYSE) under the ticker symbol SEA, has exhibited significant growth in its stock price in recent years. As a technology company operating in Southeast Asia, SEA Limited has benefited from the increasing digitalization and e-commerce trends in the region.

The stock price of SEA Stock has seen substantial gains driven by its successful expansion and innovative products and services.

Financial Health Assessment

When evaluating the financial health of Westpac ASX and SEA Stock, it is crucial to analyze key financial indicators such as revenue, profit margin, and debt levels. These factors play a significant role in determining the long-term prospects of these companies.

Revenue Comparison

- Westpac ASX: In the latest financial report, Westpac ASX reported a steady increase in revenue, indicating a positive growth trend.

- SEA Stock: SEA Stock has also shown significant revenue growth in recent years, outperforming market expectations.

Profit Margin Analysis

- Westpac ASX: The profit margin of Westpac ASX has remained relatively stable, reflecting efficient cost management strategies.

- SEA Stock: SEA Stock has demonstrated a strong profit margin, showcasing its ability to generate profits effectively.

Debt Levels Comparison

- Westpac ASX: Westpac ASX has managed its debt levels prudently, maintaining a healthy balance sheet.

- SEA Stock: SEA Stock has also kept its debt levels under control, reducing financial risks and enhancing financial stability.

Market Positioning and Competitive Landscape

When it comes to market positioning and competitive landscape, it is essential to understand how Westpac ASX and SEA Stock stand relative to their competitors in the market. Let's delve into their key competitors and how each stock differentiates itself.

Westpac ASX

Westpac ASX operates in the financial services sector, primarily focusing on banking and financial solutions. Some of its key competitors include Commonwealth Bank, ANZ, and NAB. Westpac ASX differentiates itself by offering a wide range of banking products and services, including retail banking, wealth management, and institutional banking.

The company's strong brand presence and customer-centric approach have helped it maintain a competitive edge in the market.

SEA Stock

SEA Stock operates in the technology and e-commerce sector, with a primary focus on Southeast Asia. Its key competitors include Alibaba, Amazon, and Tencent. SEA Stock differentiates itself by offering a diverse portfolio of products and services, including e-commerce, digital entertainment, and digital financial services.

The company's innovative approach to technology and strong market presence in Southeast Asia have positioned it as a key player in the region's tech industry.

Growth Prospects and Future Outlook

When looking at the growth prospects and future outlook of Westpac ASX and SEA Stock, it's important to consider various factors that could impact their performance in the long term.

Westpac ASX

- Westpac ASX has been focusing on digital transformation and innovation to enhance customer experience and streamline operations.

- The bank is also looking to expand its presence in the Asia-Pacific region, tapping into growing markets for potential growth opportunities.

- With a strong focus on sustainable finance and ESG initiatives, Westpac ASX is aligning itself with the global shift towards responsible investing.

SEA Stock

- SEA Stock, as a leading technology company in Southeast Asia, is poised for significant growth driven by the region's booming digital economy.

- The company has been investing heavily in research and development to introduce new products and services that cater to the evolving needs of consumers in the region.

- SEA Stock's strategic acquisitions and partnerships are expected to further solidify its market position and drive revenue growth in the coming years.

Risk Factors and Challenges

Investing in Westpac ASX and SEA Stock comes with its own set of risks and challenges that investors need to be aware of. These factors can significantly impact the long-term performance of each stock.

Market Volatility

Market volatility is a major risk factor that affects both Westpac ASX and SEA Stock. Fluctuations in the market can lead to sudden changes in stock prices, impacting investor portfolios. It is essential for investors to be prepared for market volatility and have a diversified investment strategy to mitigate its effects.

Regulatory Changes

Both Westpac ASX and SEA Stock are subject to regulatory changes that can impact their operations and financial performance. Changes in regulations related to banking, finance, or the maritime industry can have a direct impact on the profitability of these companies.

Investors need to stay informed about regulatory developments and assess how they could affect their investment decisions.

Industry-specific Risks

Each industry comes with its own set of risks that can affect the performance of companies operating within it. For Westpac ASX, factors like interest rate fluctuations, credit risks, and competition from fintech companies pose significant challenges. On the other hand, SEA Stock faces risks related to global trade dynamics, fuel prices, and environmental regulations.

Understanding these industry-specific risks is crucial for investors to make informed decisions.

Closing Notes

In conclusion, the analysis of Westpac ASX and SEA Stock sheds light on the nuances of these investment options, guiding investors towards informed decisions for the long term.

FAQ Corner

What factors differentiate Westpac ASX and SEA Stock from their competitors?

Westpac ASX's strong presence in the financial sector contrasts with SEA Stock's focus on innovative technology solutions, offering investors diverse options based on industry preferences.

How do market trends impact the future outlook of Westpac ASX and SEA Stock?

Market trends play a pivotal role in shaping the future prospects of both stocks, influencing investor sentiment and strategic decisions that drive long-term growth.