Westpac ASX Forecast 2025: Is It Time to Buy or Hold?

As Westpac ASX Forecast 2025: Is It Time to Buy or Hold? takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The content of the second paragraph that provides descriptive and clear information about the topic

Introduction to Westpac ASX Forecast 2025

Westpac Banking Corporation (ASX: WBC) is one of the largest banks in Australia, providing a wide range of financial services to individuals, businesses, and institutional clients. With a history dating back to 1817, Westpac has established itself as a key player in the Australian financial market.Forecasting the performance of Westpac ASX in 2025 is crucial for investors and stakeholders to make informed decisions regarding their investments.

By analyzing various factors that may influence Westpac's stock performance, investors can gain insights into the potential risks and opportunities associated with holding or buying Westpac shares.

Factors Influencing Westpac ASX Forecast 2025

- Macroeconomic Conditions: The overall economic environment, including interest rates, inflation, and GDP growth, can impact Westpac's profitability and stock price.

- Regulatory Changes: Any shifts in banking regulations or policies can affect Westpac's operations and financial performance.

- Competitive Landscape: The competitive dynamics within the banking sector, including the emergence of fintech companies, can influence Westpac's market position.

- Internal Factors: Westpac's own strategic decisions, management changes, and financial health will play a significant role in shaping its performance in 2025.

Historical Performance Analysis

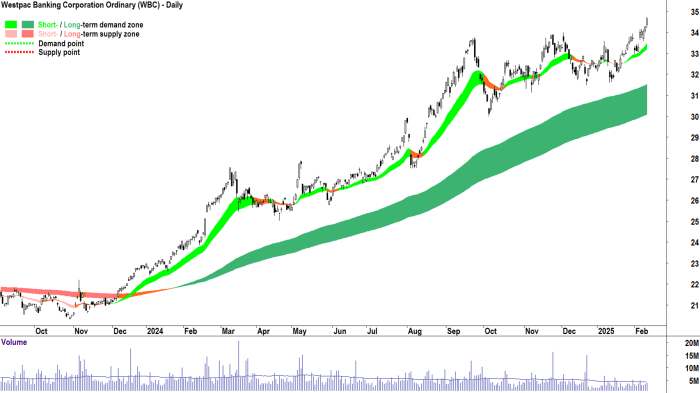

When considering whether to buy or hold Westpac ASX stocks, it is crucial to analyze its historical performance over the past few years. By comparing and contrasting the trends in Westpac ASX stock prices with industry peers, we can gain valuable insights into the company's trajectory and potential future performance.

Stock Price Trends

Westpac ASX has experienced fluctuations in its stock prices over the years, influenced by various internal and external factors. The stock prices have been impacted by market conditions, economic trends, regulatory changes, and company-specific events.

- Despite facing challenges in the banking sector, Westpac ASX has shown resilience in maintaining a relatively stable stock price compared to its competitors.

- There have been instances where Westpac ASX stock prices have outperformed industry peers due to successful strategic initiatives and strong financial performance.

- On the other hand, negative events such as regulatory issues or economic downturns have led to temporary dips in Westpac ASX stock prices.

Key Events and Strategies

Several key events and strategies have influenced Westpac ASX performance in the past, shaping its growth and market position.

- Strategic acquisitions and expansions into new markets have contributed to Westpac ASX's growth and revenue generation.

- On the other hand, regulatory challenges and compliance issues have posed obstacles for Westpac ASX, impacting its stock prices and investor confidence.

- The company's focus on digital transformation and innovation has been a key driver of performance, helping Westpac ASX adapt to changing customer preferences and market dynamics.

Market Trends and Economic Outlook

The banking sector is constantly evolving, influenced by various market trends and economic factors that can impact the performance of companies like Westpac ASX

Market Trends in the Banking Sector

- The rise of digital banking: With the increasing use of technology in financial services, banks are focusing on enhancing their digital offerings to meet customer demands for convenient and seamless banking experiences.

- Competition from fintech companies: Fintech firms are disrupting the traditional banking model by offering innovative solutions in areas like payments, lending, and personal finance management, posing a challenge to established banks like Westpac.

- Shift towards sustainable finance: Environmental, social, and governance (ESG) considerations are becoming increasingly important in banking, leading to a growing demand for sustainable finance products and services.

Economic Outlook and Impact on Westpac ASX

- The global economic recovery: As economies rebound from the impact of the COVID-19 pandemic, there is optimism for growth in key markets that could positively influence Westpac's performance.

- Interest rate environment: Changes in interest rates can affect the profitability of banks, including Westpac, as they impact borrowing costs, lending rates, and investment returns.

- Inflation and regulatory challenges: Rising inflation rates and evolving regulatory requirements may pose challenges for banks in managing costs and complying with new rules, potentially impacting Westpac's financial outlook.

Regulatory Changes and Challenges

- Compliance requirements: Banks like Westpac need to navigate a complex regulatory landscape, including stringent capital adequacy standards, anti-money laundering regulations, and data privacy laws, which can impact their operations and profitability.

- Reforms in the banking sector: Ongoing regulatory reforms aimed at enhancing transparency, risk management, and consumer protection could lead to changes in business practices and operating costs for Westpac.

Financial Health and Growth Prospects

The financial health and growth prospects of Westpac Banking Corporation are crucial factors to consider when evaluating the forecast for Westpac ASX in 2025.

Financial Health Analysis

- Westpac Banking Corporation has shown resilience in its financial health, with a strong balance sheet and capital adequacy leading up to 2025.

- Despite economic challenges, Westpac has maintained stable profitability and efficient cost management practices.

- The company's asset quality and liquidity position remain robust, providing a solid foundation for future growth.

- Westpac's consistent investment in technology and digital transformation has enhanced operational efficiency and customer experience.

Growth Prospects Evaluation

- Westpac ASX is poised for growth in terms of revenue generation, driven by a diversified product portfolio and strategic market positioning.

- Profitability is expected to improve as cost-saving initiatives and digital advancements yield positive results.

- Market share expansion is a key focus for Westpac, with targeted strategies to capture a larger share of the banking sector.

- Strategic investments in emerging markets and innovative financial solutions are expected to contribute to the overall growth trajectory of Westpac ASX.

Last Recap

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Essential Questionnaire

What are the key factors influencing the forecast for Westpac ASX in 2025?

Factors include economic conditions, market trends, and regulatory changes.

How does Westpac ASX historical performance compare to industry peers?

Westpac ASX historical performance can be compared through analyzing stock prices, growth rates, and profitability metrics.

What are some key events or strategies that have impacted Westpac ASX performance in the past?

Events like economic downturns, regulatory changes, or strategic mergers can impact Westpac ASX performance.