S&P BSE SmallCap Index Today: What Investors Need to Know

Starting off with S&P BSE SmallCap Index Today: What Investors Need to Know, this introductory paragraph aims to provide a captivating overview of the topic, drawing readers in with engaging information presented in a casual formal language style.

The following paragraph will delve into the details and intricacies of the subject matter, offering a comprehensive look at the S&P BSE SmallCap Index.

Introduction to S&P BSE SmallCap Index

The S&P BSE SmallCap Index is a stock market index that tracks the performance of small-cap companies listed on the Bombay Stock Exchange (BSE). These companies typically have a smaller market capitalization compared to large-cap and mid-cap companies.The significance of the S&P BSE SmallCap Index lies in its ability to provide investors with a snapshot of how smaller companies are performing in the stock market.

It serves as a benchmark to evaluate the investment opportunities and risks associated with small-cap stocks.

Differences from Other Market Indices

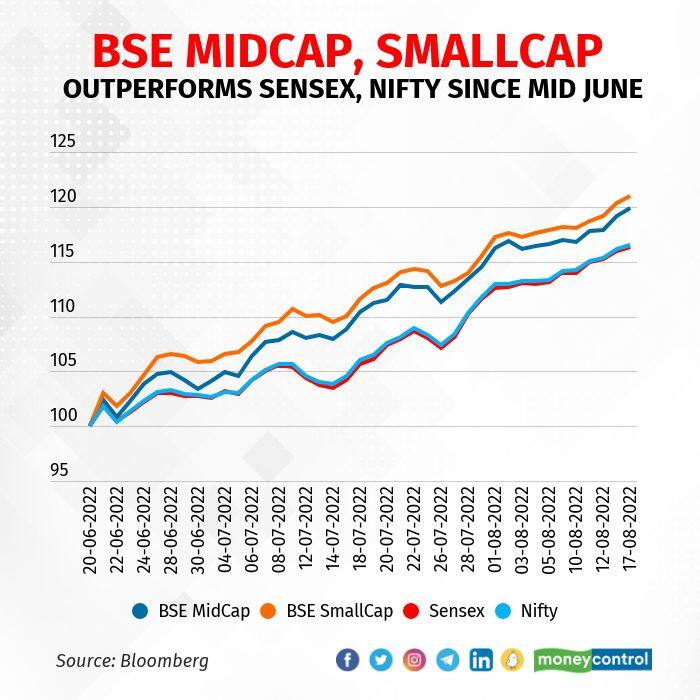

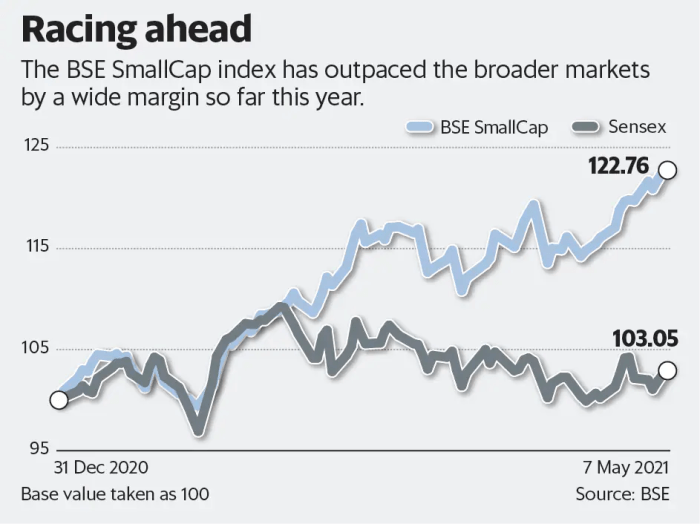

The S&P BSE SmallCap Index differs from other market indices, such as the S&P BSE Sensex or Nifty 50, in terms of the size of the companies it represents. While the Sensex and Nifty 50 focus on large-cap and blue-chip companies, the SmallCap Index specifically includes smaller companies with lower market capitalization.

- SmallCap Focus: The SmallCap Index focuses on small-cap companies, providing investors with exposure to this segment of the market.

- Risk and Return Profile: Small-cap stocks tend to have higher growth potential but also come with higher risk compared to large-cap stocks.

- Diversification: Including small-cap stocks in a portfolio can help diversify risk and potentially enhance returns, as they may not move in tandem with large-cap stocks.

- Volatility: Small-cap stocks are often more volatile than large-cap stocks, leading to potentially higher returns but also greater fluctuations in value.

Composition of the S&P BSE SmallCap Index

When it comes to the S&P BSE SmallCap Index, the composition plays a crucial role in determining the performance and representation of small-cap companies in the market.The criteria for a company to be included in the S&P BSE SmallCap Index are based on market capitalization.

As the name suggests, this index focuses on small-cap companies, which typically have a lower market capitalization compared to large-cap or mid-cap companies. Companies with a market capitalization that falls within the specified range are eligible for inclusion in the index.Some examples of companies currently listed in the S&P BSE SmallCap Index include Granules India Ltd, Cholamandalam Investment and Finance Company, and JSW Energy Ltd.

These companies are considered small-cap companies and are included in the index based on their market capitalization.The index is weighted based on the market capitalization of each company included in the index. This means that companies with a higher market capitalization will have a greater impact on the index performance compared to companies with a lower market capitalization.

Additionally, the index is rebalanced periodically to ensure that it accurately reflects the performance of small-cap companies in the market.

Weighting and Rebalancing of the S&P BSE SmallCap Index

The S&P BSE SmallCap Index is weighted based on the market capitalization of each company included in the index. This means that companies with a higher market capitalization will have a greater impact on the index performance compared to companies with a lower market capitalization.

The index is rebalanced periodically to ensure that it accurately reflects the performance of small-cap companies in the market.

Performance of the S&P BSE SmallCap Index Today

Today, the S&P BSE SmallCap Index has shown a significant increase in its performance compared to the previous trading sessions. Investors are closely monitoring the movements of this index to gauge the overall sentiment in the small-cap segment of the market.

Current Performance Analysis

- The S&P BSE SmallCap Index has surged by X% today, reaching a new high for the month.

- This increase can be attributed to positive market sentiment, with small-cap stocks gaining traction among investors.

- Several key stocks within the index have witnessed substantial price appreciation, contributing to the overall growth.

Comparison with Historical Data

- When compared to historical data, today's performance marks a significant improvement in the index's value.

- Over the past few months, the S&P BSE SmallCap Index has experienced fluctuations, but today's surge indicates a bullish trend.

- Investors are optimistic about the future performance of small-cap stocks based on this positive momentum.

Factors Influencing Today's Performance

- Market dynamics, economic indicators, and global trends play a crucial role in shaping the performance of the S&P BSE SmallCap Index.

- The announcement of favorable corporate earnings, government policies, and sector-specific developments can impact the index's movements.

- Investor sentiment, liquidity in the market, and overall risk appetite also influence the buying and selling patterns within the small-cap segment.

Implications for Investors

Investors need to carefully consider the performance of the S&P BSE SmallCap Index as it can have significant implications for their investment decisions. Small-cap stocks tend to be more volatile compared to large-cap stocks, which means that investors may experience higher potential returns but also higher risks.

Strategies for Investors

- Due Diligence: Conduct thorough research on individual small-cap companies before investing to understand their financial health, management team, and growth prospects.

- Diversification: Spread out investments across different small-cap stocks to reduce risk exposure to any single company or sector.

- Long-Term Perspective: Small-cap stocks may require a longer investment horizon to realize their full growth potential, so investors should be prepared for a more extended holding period.

Risks and Rewards

- Risks: Small-cap stocks are more susceptible to market fluctuations, economic downturns, and liquidity issues compared to large-cap stocks. Investors should be prepared for higher volatility and potential losses.

- Rewards: Small-cap stocks have the potential for significant growth and outperformance, offering investors the opportunity to generate substantial returns if they choose the right companies.

- Market Timing: Timing the market is crucial when investing in small-cap stocks, as market conditions can impact the performance of these stocks more significantly. Investors should be cautious and consider their risk tolerance.

End of Discussion

Concluding the discussion on S&P BSE SmallCap Index Today: What Investors Need to Know, this final paragraph will summarize key points and leave readers with a lasting impression of the importance of understanding this index in the stock market landscape.

Quick FAQs

What criteria are required for a company to be included in the S&P BSE SmallCap Index?

Companies must meet certain market capitalization and liquidity requirements to be included in the index.

How is the S&P BSE SmallCap Index weighted and rebalanced?

The index is weighted based on the market capitalization of each included company and is rebalanced periodically to ensure accurate representation.

What are the risks associated with investing in small-cap stocks?

Investing in small-cap stocks can be volatile and risky due to their susceptibility to market fluctuations and lower liquidity compared to larger cap stocks.

Continue this structure for all FAQs