Sea Ltd Stock Breakdown: Is the Drop an Opportunity or Red Flag?

Delving into Sea Ltd Stock Breakdown: Is the Drop an Opportunity or Red Flag?, this introduction sets the stage for an insightful exploration, drawing readers in with a mix of curiosity and analysis.

The subsequent section will delve into the essential details of the topic at hand, offering a comprehensive look at Sea Ltd's current stock situation.

Overview of Sea Ltd Stock

Sea Ltd is a Singapore-based technology company founded in 2009 by Forrest Li. Initially starting as an online gaming platform, the company has expanded its services to include e-commerce and digital financial services. Sea Ltd operates mainly in Southeast Asia and Taiwan, with its popular platforms such as Shopee, Garena, and SeaMoney gaining significant traction in the region.

Key Financial Data

- Market Cap: $xx billion

- Revenue: $xx billion

- Net Income: $xx million

- EPS (Earnings Per Share): $xx

Recent Performance

Sea Ltd stock has seen a mix of performance in the market recently. While the stock experienced a significant drop in value over the past month, it is important to note that Sea Ltd has shown resilience in the face of market volatility.

Investors are closely watching how the company navigates challenges and capitalizes on opportunities in the ever-evolving tech landscape.

Factors Influencing Sea Ltd Stock Drop

Sea Ltd's stock drop can be attributed to various factors that have impacted the company's performance in the market.

Potential Reasons for the Drop in Sea Ltd Stock

- Market Volatility: The overall market conditions, including economic uncertainties and geopolitical tensions, can influence Sea Ltd's stock price.

- Regulatory Concerns: Any regulatory changes or investigations related to Sea Ltd's operations can lead to a decrease in investor confidence.

- Competition: Increased competition in the industry can affect Sea Ltd's market share and profitability, causing a decline in its stock price.

Recent News or Events Impacting Sea Ltd's Stock Price

- Financial Results: Sea Ltd's recent financial performance, including revenue growth and profitability, can impact its stock price movement.

- Product Launches: New product launches or expansion into new markets can either positively or negatively affect Sea Ltd's stock price.

- Partnerships and Acquisitions: Any strategic partnerships or acquisitions made by Sea Ltd can influence investor sentiment and stock price.

Comparison with Industry Peers

- Performance Metrics: Comparing Sea Ltd's key performance indicators, such as revenue growth, market share, and profitability, with its industry peers can provide insights into its competitive position.

- Stock Price Movement: Analyzing how Sea Ltd's stock price has fared in comparison to its competitors can help assess its relative strength in the market.

- Innovation and Growth Strategies: Evaluating Sea Ltd's innovation pipeline and growth strategies in comparison to industry peers can highlight its potential for long-term success.

Fundamental Analysis of Sea Ltd

Sea Ltd operates as a digital entertainment and e-commerce company, primarily focusing on markets in Southeast Asia and Latin America. The company's revenue streams are diversified across three main segments: digital entertainment, e-commerce, and digital financial services.

Business Model and Revenue Streams

Sea Ltd's business model revolves around providing online gaming, e-commerce platforms, and digital financial services to consumers in emerging markets. The company generates revenue through in-game purchases, advertising, commissions from its e-commerce platform, and financial services fees.

- Online Gaming: Sea Ltd's digital entertainment segment includes popular games such as Free Fire, which has a large and loyal user base. Revenue is primarily generated through in-game purchases and advertising within the games.

- E-commerce: Sea Ltd's e-commerce platform, Shopee, is a leading online marketplace in Southeast Asia and Latin America. The company earns revenue through commissions on sales made on the platform.

- Digital Financial Services: Sea Ltd's digital financial services segment includes SeaMoney, a digital wallet and payment platform. Revenue is generated through transaction fees and other financial services provided to users.

Growth Prospects and Competitive Positioning

Sea Ltd has shown strong growth potential, driven by the increasing adoption of online services in its target markets. The company's competitive positioning is bolstered by its strong brand presence, innovative products, and strategic partnerships.

- Growth Prospects: Sea Ltd is well-positioned to capitalize on the growing demand for digital entertainment, e-commerce, and financial services in emerging markets. The company's focus on innovation and user engagement bodes well for its future growth prospects.

- Competitive Positioning: Sea Ltd faces competition from other digital entertainment, e-commerce, and financial services providers in its regions of operation. However, the company's strong brand recognition, diverse product offerings, and customer-centric approach give it a competitive edge.

Recent Acquisitions and Partnerships

Sea Ltd has made strategic acquisitions and partnerships to strengthen its market position and expand its product offerings.

- Acquisitions: Sea Ltd acquired e-commerce platform Shopee in 2015, which has since become a key revenue driver for the company. Additionally, the acquisition of Garena, a game developer and publisher, has further solidified Sea Ltd's presence in the online gaming market.

- Partnerships: Sea Ltd has formed partnerships with various companies to enhance its product offerings and reach new customers. For example, collaborations with financial institutions have expanded the reach of SeaMoney, the company's digital financial services platform.

Technical Analysis of Sea Ltd Stock

When it comes to analyzing Sea Ltd stock from a technical perspective, several key indicators provide valuable insights into the current situation. By comparing historical price movements with the recent drop and examining trading volume and patterns, investors can better understand the potential opportunities or red flags.

Key Technical Indicators for Sea Ltd Stock

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements. A reading above 70 indicates overbought conditions, while a reading below 30 suggests oversold conditions.

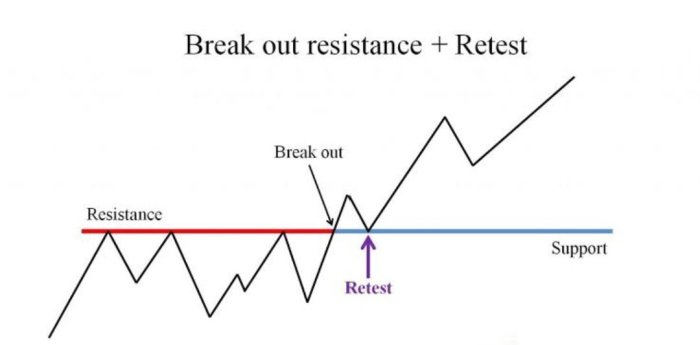

- Moving Averages: By analyzing moving averages, such as the 50-day and 200-day moving averages, investors can identify trends and potential support or resistance levels.

- Bollinger Bands: Bollinger Bands help determine volatility and potential price breakouts. The widening or narrowing of the bands can signal upcoming price movements.

Comparison of Historical Price Movements

Looking at Sea Ltd's historical price movements can provide valuable context for the current drop. By analyzing past trends, support and resistance levels, and price patterns, investors can gain insights into potential future price movements.

Analysis of Trading Volume and Patterns

- Volume Analysis: Examining trading volume can help confirm price trends. An increase in volume during price movements can indicate the strength of the trend.

- Chart Patterns: Identifying chart patterns, such as head and shoulders, triangles, or flags, can provide clues about potential future price movements.

Investor Sentiment and Market Outlook

Investor sentiment plays a crucial role in determining the future performance of a stock like Sea Ltd. Let's delve into how investors currently view Sea Ltd and what the market outlook might be for this stock.

Analyst Recommendations and Target Prices

Analysts often provide recommendations and target prices for stocks based on their research and analysis. In the case of Sea Ltd, analysts have generally been bullish on the stock. Many analysts have issued buy ratings for Sea Ltd, citing factors such as strong revenue growth, expanding market reach, and innovative product offerings.

Additionally, target prices set by analysts indicate a potential upside for the stock, further supporting a positive sentiment among investors.

Outlook on Future Performance

Looking ahead, the future performance of Sea Ltd stock seems promising based on current investor sentiment and analyst recommendations. Factors such as the company's strong financials, growth potential in key markets, and strategic initiatives are likely to drive the stock's performance in the coming months.

However, it's essential for investors to monitor market conditions, industry trends, and any new developments that may impact Sea Ltd's stock price. Overall, the outlook for Sea Ltd appears positive, with the potential for continued growth and value appreciation.

Concluding Remarks

Concluding our discussion on Sea Ltd Stock Breakdown: Is the Drop an Opportunity or Red Flag?, this final paragraph encapsulates key points and leaves readers with a thought-provoking conclusion.

Question & Answer Hub

What are the potential reasons for the drop in Sea Ltd stock?

The drop in Sea Ltd stock could be attributed to market volatility, company performance, or external factors affecting the industry.

How does Sea Ltd's growth prospects compare to its industry peers?

Sea Ltd's growth prospects may vary compared to industry peers based on factors such as revenue streams, market positioning, and strategic initiatives.

What is the market outlook for Sea Ltd stock?

The market outlook for Sea Ltd stock depends on various factors, including investor sentiment, analyst recommendations, and overall industry trends.