Revolving vs Non-Revolving Business Credit Lines Explained: A Comprehensive Guide

Delve into the world of business credit lines with a detailed exploration of the differences between revolving and non-revolving options. Learn how businesses can benefit from these financial tools and make informed decisions for their growth and success.

Introduction to Business Credit Lines

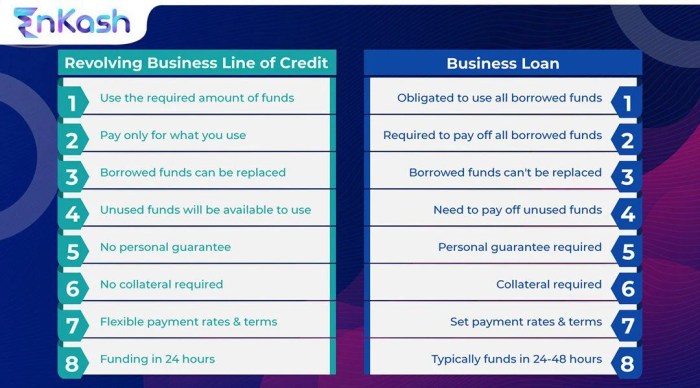

A business credit line is a type of financial product that provides businesses with access to a predetermined amount of funds that can be drawn upon as needed. It operates similarly to a credit card, allowing businesses to borrow funds up to a certain limit and repay them with interest.

Business credit lines differ from traditional loans in that they offer more flexibility in terms of borrowing and repayment. While traditional loans provide a lump sum of money that must be repaid in fixed installments, credit lines allow businesses to borrow as needed and only pay interest on the amount they use.

Typical Uses of Business Credit Lines

- Working capital: Businesses often use credit lines to cover day-to-day operational expenses, such as payroll, inventory purchases, and rent.

- Seasonal fluctuations: Credit lines can help businesses manage cash flow during slow seasons or periods of high demand.

- Expansion: Funds from a credit line can be used to finance business growth, such as opening new locations or launching new products.

- Emergency expenses: Credit lines provide a financial safety net for unexpected costs, such as equipment repairs or legal fees.

Revolving Business Credit Lines

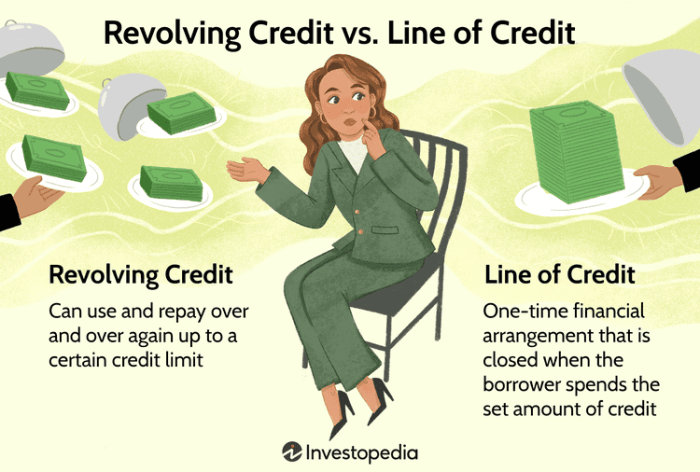

Revolving credit lines in the context of business refer to a type of financing that provides a predetermined credit limit that can be used repeatedly. As payments are made, the available credit is replenished, allowing for ongoing access to funds.

How Revolving Credit Lines Work

Revolving credit lines work by giving businesses access to a set credit limit that can be used as needed. Once the funds are borrowed, the business can repay the amount and use the credit again without having to reapply for a new loan.

This flexibility makes revolving credit lines ideal for managing cash flow fluctuations and funding short-term expenses.

Examples of Businesses that Benefit from Revolving Credit Lines

- A retail business that needs to purchase inventory to stock up for seasonal demand fluctuations.

- A small business that experiences periodic cash flow gaps and needs a financial cushion to cover expenses during slow months.

- A tech startup that requires ongoing funding for research and development projects without the need for multiple loan applications.

Non-Revolving Business Credit Lines

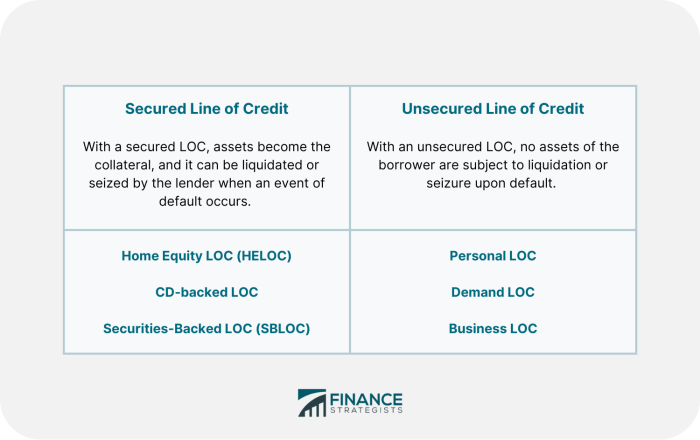

Non-revolving business credit lines are a type of credit that provides businesses with a fixed amount of funds that cannot be reused once they are repaid. Unlike revolving credit lines, which allow for continual borrowing as long as the credit limit is not exceeded, non-revolving credit lines have a finite lifespan and are typically used for specific one-time expenses or investments.

Characteristics of Non-Revolving Credit Lines

Non-revolving credit lines have the following characteristics:

- Fixed Amount: Non-revolving credit lines provide a set amount of funds that cannot be increased once the line of credit is established.

- Fixed Repayment Term: These credit lines come with a predetermined repayment schedule, often with fixed monthly payments until the entire balance is paid off.

- Non-Renewable: Once the funds are used and repaid, the credit line is typically closed and cannot be used again.

- Specific Purpose: Non-revolving credit lines are usually intended for a specific purpose, such as purchasing equipment, financing a project, or covering a major expense.

Comparison with Revolving Credit Lines

Non-revolving credit lines differ from revolving credit lines in the following ways:

- Usage: Revolving credit lines can be used repeatedly as long as the credit limit is not exceeded, while non-revolving credit lines can only be used once.

- Flexibility: Revolving credit lines offer flexibility in borrowing and repayment, whereas non-revolving credit lines have a fixed amount and repayment schedule.

- Cost: Non-revolving credit lines may have lower interest rates compared to revolving credit lines, as they are typically used for larger, one-time expenses.

Advantages of Revolving Credit Lines

Revolving credit lines offer various advantages to businesses, providing them with the flexibility and financial freedom they need to manage their cash flow effectively.

Flexibility in Credit Usage

- Businesses can access funds as needed, up to a predetermined credit limit, giving them the flexibility to use the funds for various purposes such as inventory purchases, equipment upgrades, or covering unexpected expenses.

- Unlike traditional term loans, revolving credit lines allow businesses to borrow, repay, and borrow again without the need to reapply for a new loan each time, making it a convenient option for managing short-term financing needs.

Interest Only on Amounts Used

- Businesses are only charged interest on the amount of credit they use, not the entire credit limit, which can result in cost savings compared to term loans where interest is charged on the full loan amount.

- This pay-as-you-go structure can help businesses better manage their interest expenses and cash flow, especially during periods of fluctuating revenue or unforeseen expenses.

Boosts Cash Flow Management

- Revolving credit lines provide a safety net for businesses to cover cash flow gaps, ensuring they can meet their financial obligations, pay employees, and seize growth opportunities when needed.

- By having access to a revolving credit line, businesses can navigate seasonal fluctuations, take advantage of supplier discounts, and invest in growth initiatives without disrupting their cash flow.

Advantages of Non-Revolving Credit Lines

Non-revolving credit lines offer distinct advantages compared to revolving credit lines, making them suitable for specific business needs. These advantages include:

Lower Interest Rates

Non-revolving credit lines often come with lower interest rates compared to revolving credit lines, making them a cost-effective option for businesses looking to borrow funds.

Predictable Repayment Terms

Non-revolving credit lines typically have fixed repayment terms, allowing businesses to budget and plan for repayments without the uncertainty of fluctuating interest rates or payment amounts.

Larger Loan Amounts

Non-revolving credit lines may provide access to larger loan amounts, making them ideal for businesses that require substantial funding for major projects, expansions, or investments.

Collateral Flexibility

Non-revolving credit lines may offer more flexibility in terms of collateral requirements, allowing businesses to secure the credit line with various assets or properties.

Industry Examples

Some industries that commonly use non-revolving credit lines include manufacturing, construction, healthcare, and transportation. These businesses often require significant capital for equipment purchases, infrastructure development, or facility expansions, making non-revolving credit lines a suitable financing option.

Closing Summary

In conclusion, understanding the nuances of revolving and non-revolving business credit lines is crucial for making sound financial choices. By weighing the advantages of each, businesses can strategically leverage credit to achieve their goals and thrive in a competitive market.

FAQ Corner

What sets revolving credit lines apart from non-revolving ones?

Revolving credit lines offer flexibility in borrowing and repayment, unlike non-revolving lines that have a fixed term and repayment schedule.

How can businesses determine which type of credit line is suitable for their needs?

Businesses should assess their cash flow requirements, borrowing preferences, and financial goals to choose between revolving and non-revolving credit lines.

Are there specific industries that benefit more from non-revolving credit lines?

Industries with seasonal fluctuations in revenue or large one-time expenses often find non-revolving credit lines more suitable for managing their finances.