Live Updates: BSE Small Cap Index Performance Today

Beginning with Live Updates: BSE Small Cap Index Performance Today, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

As we delve into the details, we aim to provide a comprehensive overview of the BSE Small Cap Index and its performance on the current day.

Overview of BSE Small Cap Index

The BSE Small Cap Index is a stock market index that tracks the performance of small-cap companies listed on the Bombay Stock Exchange (BSE). Small-cap companies are typically smaller in market capitalization compared to large-cap and mid-cap companies.

The BSE Small Cap Index is calculated using the free-float market capitalization method. This means that the index is weighted based on the available shares in the market that are available for trading, excluding locked-in shares or shares held by promoters.

Significance of BSE Small Cap Index

The BSE Small Cap Index plays a crucial role in the financial market as it provides investors with a gauge of the performance of small-cap stocks. Small-cap stocks are known for their potential for high growth, making them attractive to investors looking for higher returns but also bearing higher risk.

- Investment Opportunities: The BSE Small Cap Index offers investors the opportunity to invest in small-cap companies that have the potential for significant growth, providing diversification benefits to their investment portfolios.

- Risk Indicator: The performance of the BSE Small Cap Index can serve as an indicator of market sentiment towards small-cap stocks. A rising index may indicate investor confidence in the growth prospects of small-cap companies.

- Market Dynamics: The movements of the BSE Small Cap Index reflect the broader market dynamics and economic conditions, making it a valuable tool for market analysts and researchers.

Factors Influencing Small Cap Index Performance

Small Cap Index performance is influenced by a variety of factors that differentiate it from other market indices. The unique characteristics of small-cap companies play a significant role in determining the performance of the BSE Small Cap Index.

Market Capitalization

Market capitalization is a key factor that influences the Small Cap Index performance. Small-cap companies typically have a lower market capitalization compared to large-cap companies, making them more susceptible to market volatility. As a result, changes in market sentiment can have a more pronounced impact on the Small Cap Index compared to other indices.

Economic Conditions

The overall economic conditions also play a crucial role in influencing the performance of the Small Cap Index. Small-cap companies are more sensitive to economic downturns and fluctuations, as they often lack the resources and resilience of larger companies. Factors such as interest rates, inflation, and GDP growth can significantly impact the performance of the Small Cap Index.

Sectoral Exposure

The sectoral exposure of the Small Cap Index is another important factor to consider. Small-cap companies are often concentrated in specific sectors, which can make the index more vulnerable to sector-specific risks. For example, a downturn in the technology sector can have a disproportionate impact on the Small Cap Index if a significant number of small-cap technology companies are included.

Recent Events Impacting Small Cap Index

Recent events such as the COVID-19 pandemic and global economic uncertainty have had a significant impact on the Small Cap Index performance. The pandemic led to widespread market volatility, causing small-cap stocks to experience sharp declines. As economic conditions continue to evolve, the performance of the Small Cap Index will be closely tied to the recovery and resilience of small-cap companies.

Historical Performance Trends

When analyzing the historical performance trends of the BSE Small Cap Index, we can observe various patterns and anomalies that have influenced its performance over the years. These trends are essential for investors and analysts to understand the behavior of small-cap stocks in different economic environments

Impact of Economic Cycles

- During economic downturns or recessions, the Small Cap Index tends to experience more significant fluctuations compared to large-cap indices. This is due to the higher volatility and risk associated with small-cap stocks.

- In contrast, during economic expansions or bull markets, small-cap stocks have the potential to outperform large-cap stocks, leading to a surge in the Small Cap Index.

- The Small Cap Index may also be influenced by sector-specific economic trends, where certain industries perform better or worse based on the overall economic conditions.

Comparison with Other Market Indices

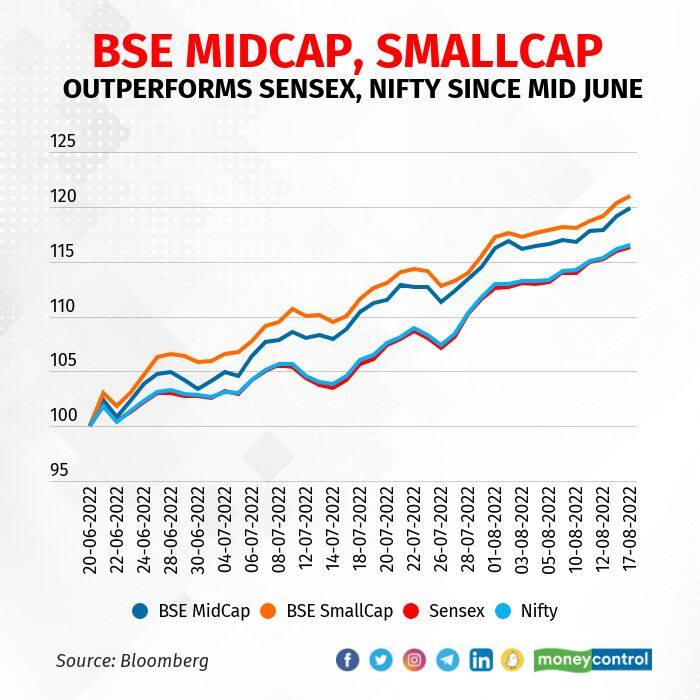

When comparing the performance of the BSE Small Cap Index with other major market indices, it is important to understand the differences and similarities that exist.

Differences Between Small Cap Index and Large-Cap/Mid-Cap Indices

- The main difference between the Small Cap Index and large-cap/mid-cap indices lies in the market capitalization of the companies included in each index. Small cap companies typically have a market capitalization lower than that of mid-cap and large-cap companies.

- Small cap companies are often considered riskier investments compared to large-cap companies due to factors such as volatility, liquidity, and financial stability.

- Large-cap companies are more established and have a proven track record of performance, while small cap companies are usually in the early stages of growth and development.

Reasons Behind Performance Gaps/Similarities

- Performance gaps between the Small Cap Index and other indices can be influenced by factors such as market conditions, economic trends, and investor sentiment.

- In times of economic uncertainty or market volatility, small cap companies may experience sharper declines compared to large-cap companies due to their higher risk profile.

- Conversely, during periods of economic growth or market optimism, small cap companies have the potential to outperform large-cap companies as investors seek higher returns.

Ending Remarks

In conclusion, the Live Updates on BSE Small Cap Index Performance Today offer valuable insights into the trends and movements of this particular market index, shedding light on its significance and impact on the financial landscape.

General Inquiries

What is the BSE Small Cap Index?

The BSE Small Cap Index is a stock market index that tracks the performance of small-cap companies listed on the Bombay Stock Exchange.

How is the BSE Small Cap Index calculated?

The BSE Small Cap Index is calculated using the free-float market capitalization method, where the market capitalization of each company in the index is multiplied by its free-float factor.

Why is the BSE Small Cap Index important in the financial market?

The BSE Small Cap Index is important as it provides insights into the performance of smaller companies, which can be indicators of market trends and economic conditions.