How to Analyze the BSE Small Cap Index for Long-Term Growth

Delving into the intricacies of the BSE Small Cap Index opens up a world of opportunities for long-term growth. This guide will navigate you through the key aspects and factors that play a pivotal role in analyzing this index, offering valuable insights for strategic investment decisions.

In this article, we will explore the fundamental components that drive the growth of the BSE Small Cap Index, shedding light on the nuances that set it apart in the dynamic landscape of the stock market.

Understanding the BSE Small Cap Index

The BSE Small Cap Index is a market index that tracks the performance of small-cap companies listed on the Bombay Stock Exchange (BSE) in India. These companies have a smaller market capitalization compared to large-cap and mid-cap companies.

Significance of the BSE Small Cap Index

The BSE Small Cap Index is significant in the stock market as it provides investors with a way to gauge the performance of smaller companies. It is often used as a benchmark to assess the overall health of the small-cap segment of the market.

Investors can use this index to diversify their portfolios and potentially benefit from the growth opportunities offered by small-cap companies.

Companies included in the BSE Small Cap Index

The BSE Small Cap Index includes a diverse range of small-cap companies from various sectors such as technology, healthcare, consumer goods, and more. These companies are known for their growth potential and are considered riskier investments compared to large-cap companies due to their smaller size and market capitalization.

Differences from other market indices

Unlike other market indices like the BSE Sensex or Nifty 50, which track large-cap companies, the BSE Small Cap Index focuses specifically on small-cap companies. This index tends to be more volatile and can experience greater price fluctuations compared to indices tracking larger companies.

Additionally, small-cap companies have the potential for rapid growth but also come with higher risks, making the BSE Small Cap Index a unique investment opportunity for those seeking long-term growth.

Factors Influencing Long-Term Growth

When looking at the long-term growth prospects of the BSE Small Cap Index, several key factors come into play. These factors can significantly impact the performance of small-cap stocks in the index over an extended period of time.

Economic Conditions Impact

Economic conditions play a crucial role in influencing the growth of small-cap stocks in the BSE Small Cap Index. During periods of economic growth, small-cap companies tend to perform well as they benefit from increased consumer spending, higher business investments, and overall positive market sentiment.

Conversely, during economic downturns, small-cap stocks may face challenges due to reduced consumer demand, tighter credit conditions, and lower investor confidence.

Industry Trends Role

Industry trends also have a significant impact on the long-term performance of the BSE Small Cap Index. Small-cap companies operating in growing sectors or emerging industries are likely to experience higher growth rates compared to those in declining industries. Understanding and capitalizing on industry trends can help investors identify opportunities for long-term growth within the small-cap segment of the market.

Regulatory Changes Affect

Regulatory changes can greatly affect the growth prospects of small-cap companies in the BSE Small Cap Index. Changes in regulations related to taxation, compliance, environmental standards, or industry-specific laws can impact the profitability and operations of small-cap firms. Investors need to stay informed about regulatory developments and assess how these changes may influence the long-term growth potential of small-cap stocks in the index.

Performance Metrics and Indicators

When analyzing the growth potential of small-cap stocks, investors often rely on various performance metrics and indicators to make informed decisions. These tools help assess the historical performance and predict future trends in the market.

Key Performance Metrics for Small-Cap Stocks

Performance metrics commonly used for analyzing small-cap stocks include:

- Price-to-earnings (P/E) ratio

- Price-to-book (P/B) ratio

- Return on equity (ROE)

- Debt-to-equity ratio

- Market capitalization

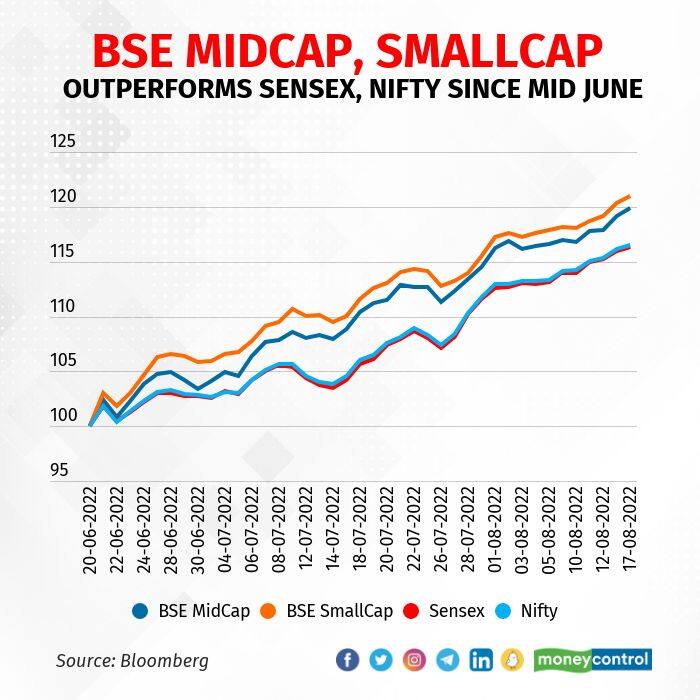

Comparison of BSE Small Cap Index with Other Market Indices

When comparing the performance indicators of the BSE Small Cap Index with other market indices, it is essential to consider factors like volatility, liquidity, and correlation with broader market trends.

Some key differences between the BSE Small Cap Index and other indices can include:

- Different sector composition

- Varying levels of risk and return

- Diverse market capitalization ranges

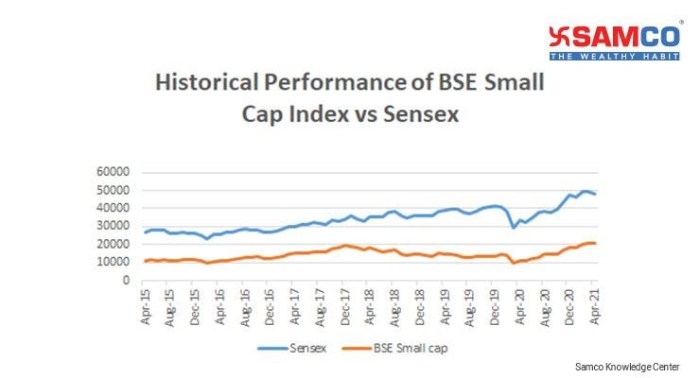

Historical Performance Data Analysis

Analyzing the historical performance data of the BSE Small Cap Index can provide valuable insights into long-term growth trends. By examining past price movements, volatility, and correlation with macroeconomic factors, investors can make more informed decisions.

It is crucial to consider both short-term fluctuations and long-term trends when analyzing historical performance data.

Dividend Yields and Earnings Growth as Indicators

Dividend yields and earnings growth are important indicators of long-term growth for small-cap stocks. A consistent increase in dividend payouts and robust earnings growth can signal a healthy financial performance and potential for future growth.

Risks and Challenges

Investing in small-cap stocks as part of the BSE Small Cap Index comes with its own set of risks and challenges. These factors can significantly impact the long-term growth prospects of these companies and the overall index.

Market Volatility Impact

Market volatility plays a crucial role in determining the performance of small-cap stocks in the BSE Small Cap Index. The unpredictable nature of the market can lead to rapid price fluctuations, which may affect investor sentiment and confidence. This volatility can result in sudden and drastic changes in the value of small-cap stocks, making it challenging for investors to predict and plan for long-term growth.

- Small-cap stocks are more susceptible to market volatility compared to large-cap stocks due to their lower market capitalization.

- Sharp market fluctuations can lead to increased risk exposure for investors holding small-cap stocks in the BSE Small Cap Index.

- Investors need to carefully monitor market conditions and trends to mitigate the impact of volatility on their investment portfolios.

Geopolitical Events Risks

Geopolitical events such as trade wars, political instability, and global economic crises can pose significant risks to the long-term growth of small-cap stocks in the BSE Small Cap Index. These events can disrupt the business environment, affect consumer sentiment, and impact the overall performance of small-cap companies.

Geopolitical tensions can lead to fluctuations in currency values, trade policies, and market regulations, directly impacting the profitability and growth prospects of small-cap stocks.

- Investors need to stay informed about geopolitical developments and their potential impact on the companies included in the BSE Small Cap Index.

- Geopolitical risks can create uncertainty in the market, leading to increased volatility and reduced investor confidence in small-cap stocks.

- Diversification and risk management strategies are essential to navigate the challenges posed by geopolitical events and safeguard long-term investment growth.

Wrap-Up

As we conclude our exploration of How to Analyze the BSE Small Cap Index for Long-Term Growth, it becomes evident that a deep understanding of its intricacies is crucial for informed investment decisions. Armed with this knowledge, investors can navigate the complexities of the market with confidence and foresight.

FAQ Guide

What are some key factors influencing the long-term growth of the BSE Small Cap Index?

Factors such as economic conditions, industry trends, regulatory changes, dividend yields, and earnings growth play a significant role in determining the growth prospects of the index.

What risks are associated with investing in small-cap stocks within the BSE Small Cap Index?

Investing in small-cap stocks carries risks such as market volatility, geopolitical events, and specific challenges related to analyzing the long-term growth potential of these companies.

How does the performance of the BSE Small Cap Index compare to other market indices?

The performance of the BSE Small Cap Index can be compared with other indices to gauge its relative strength and growth potential in the market.