Comparing Growth: BSE Small Cap Index vs S&P 500 in 2025

Comparing Growth: BSE Small Cap Index vs S&P 500 in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the world of financial markets, exploring the dynamics between small-cap and large-cap indexes, a fascinating journey awaits.

Exploring the performance of these indices in the upcoming year provides valuable insights into the trends shaping the market landscape, offering investors a unique perspective to consider for their investment decisions.

Introduction

The BSE Small Cap Index and the S&P 500 are two key stock market indexes that represent different segments of the market. The BSE Small Cap Index tracks the performance of small-cap companies listed on the Bombay Stock Exchange in India, while the S&P 500 is a benchmark index of 500 large-cap companies listed on the US stock exchanges.

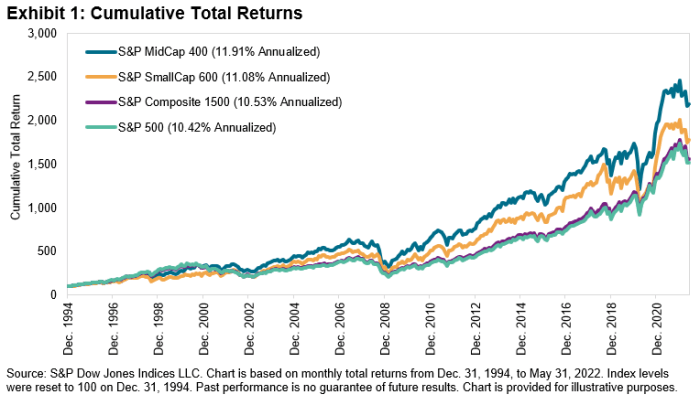

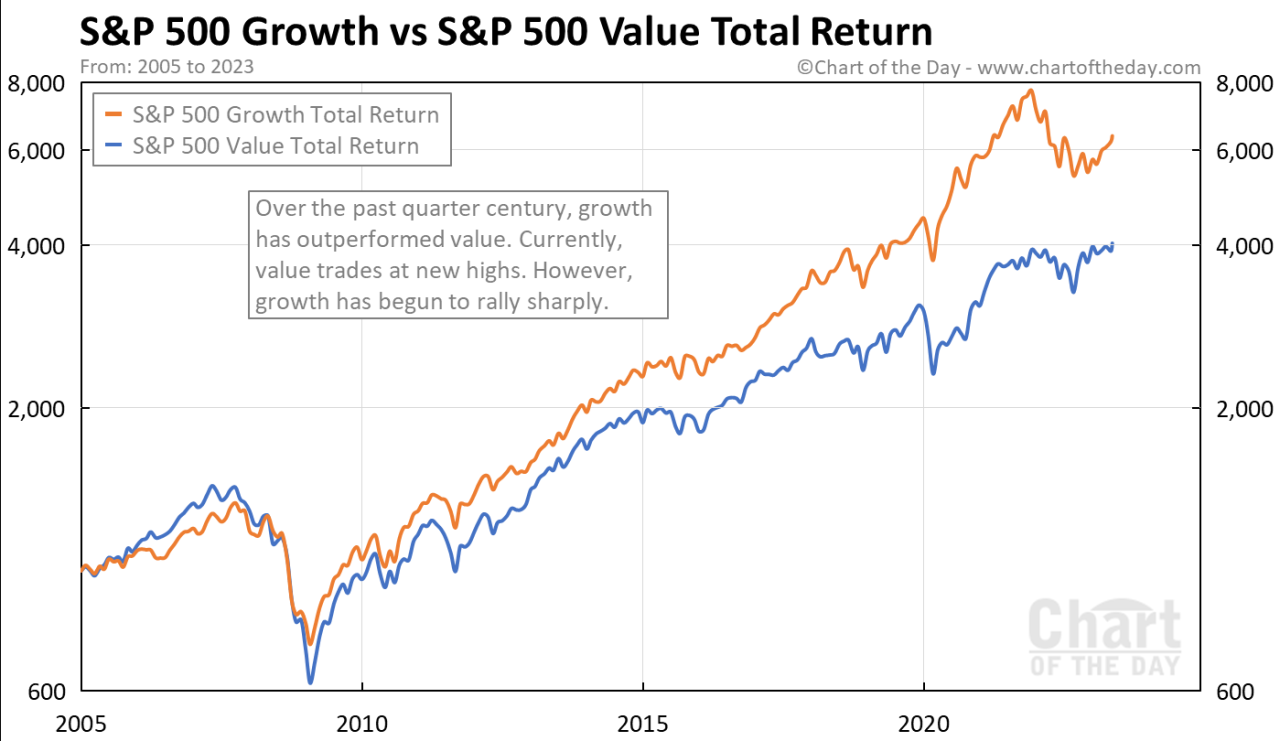

Comparing the growth of these indexes in 2025 provides valuable insights into the performance of small-cap versus large-cap stocks and the overall market trends.Small-cap and large-cap indexes play distinct roles in the financial market. Small-cap indexes like the BSE Small Cap Index are often considered riskier but have the potential for higher returns due to their growth opportunities and volatility.

On the other hand, large-cap indexes like the S&P 500 are seen as more stable and less volatile, making them attractive to investors seeking steady growth and dividends. Understanding how these indexes perform in 2025 can help investors make informed decisions based on their risk tolerance and investment goals.

Methodology

To track and analyze the growth of the BSE Small Cap Index and the S&P 500, a combination of quantitative and qualitative methods is utilized. Quantitative analysis involves examining numerical data, such as historical stock prices, market capitalization, and dividend yields.

Qualitative analysis, on the other hand, considers factors like market trends, economic indicators, and company performance.

Factors Considered for Comparison

- Market Capitalization: The size of the companies in each index is a crucial factor in comparing their performance. Small-cap companies in the BSE Small Cap Index may exhibit different growth patterns compared to large-cap companies in the S&P 500.

- Sector Allocation: The distribution of industries within each index plays a role in performance comparison. Variations in sector performance can impact the overall growth of the indexes.

- Volatility: Assessing the volatility of each index helps in understanding the risk associated with investing in them. Higher volatility may indicate greater potential returns but also higher risk.

Tools and Techniques

Technical analysis tools like moving averages, relative strength index (RSI), and Fibonacci retracement levels are used to identify trends and potential entry/exit points for investments.

Fundamental analysis is conducted to evaluate the financial health and growth prospects of the companies within the indexes, helping in making informed investment decisions.

Historical Performance

In recent years, the historical performance of the BSE Small Cap Index and the S&P 500 has been subject to various trends and patterns that reflect the dynamics of the global financial markets.The BSE Small Cap Index, representing the performance of small-cap companies in the Indian stock market, has shown significant volatility compared to the S&P 500, which tracks the performance of large-cap U.S.

companies. The BSE Small Cap Index tends to experience more pronounced fluctuations due to the nature of small-cap stocks, which are generally riskier but also have the potential for higher returns.

Trends and Patterns

Over the years, the BSE Small Cap Index has exhibited periods of rapid growth followed by sharp corrections, reflecting the higher volatility associated with small-cap stocks. On the other hand, the S&P 500 has shown more stability and consistent growth, with occasional market corrections.Factors influencing the performance of these indexes include macroeconomic indicators, geopolitical events, industry-specific trends, and investor sentiment.

For the BSE Small Cap Index, regulatory changes, economic reforms, and sector-specific developments in the Indian economy have played a significant role in shaping its historical performance. In contrast, the S&P 500 is influenced by factors such as U.S. economic data, corporate earnings reports, and global market trends.

Impact of External Factors

External factors, such as interest rate fluctuations, inflation rates, currency movements, and global trade dynamics, have also impacted the historical performance of both indexes. Changes in government policies, trade agreements, and technological advancements have further influenced the growth trajectories of the BSE Small Cap Index and the S&P 500.In conclusion, the historical performance of the BSE Small Cap Index and the S&P 500 reflects the diverse factors that drive the global financial markets.

Understanding these trends and patterns can provide valuable insights for investors looking to navigate the complexities of small-cap and large-cap stocks in different market environments.

Market Dynamics

When it comes to the growth of small-cap companies represented in the BSE Small Cap Index, various market dynamics come into play that can significantly impact their performance in 2025.

BSE Small Cap Index Dynamics

The market dynamics influencing the growth of small-cap companies in the BSE Small Cap Index include:

- The overall economic conditions in India, such as GDP growth rates, inflation, and interest rates, can affect the performance of small-cap companies.

- Sector-specific trends and developments that impact industries represented in the index, leading to varying growth trajectories for different sectors.

- Market sentiment and investor confidence, which can drive fluctuations in stock prices of small-cap companies.

S&P 500 Dynamics

On the other hand, the macroeconomic factors influencing the performance of companies in the S&P 500 are crucial in determining their growth potential in 2025.

- Global economic conditions, trade policies, and geopolitical events can have a significant impact on the multinational companies included in the S&P 500.

- Interest rates set by the Federal Reserve, inflation rates, and consumer spending trends play a vital role in shaping the performance of large-cap companies in the index.

- Technological advancements and regulatory changes can drive innovation and disruption within industries represented in the S&P 500, influencing growth trajectories.

Comparison of Market Dynamics

Considering these market dynamics, it is evident that the growth trajectories of the BSE Small Cap Index and the S&P 500 may follow distinct paths in 2025.

- The BSE Small Cap Index may be more influenced by domestic factors and sector-specific trends, leading to varying performances among small-cap companies.

- On the other hand, the S&P 500 companies may be more impacted by global economic conditions and technological advancements, shaping their growth prospects in the international market.

- Investor sentiment and market volatility could also play a crucial role in determining the relative performance of the two indexes in 2025.

Sectoral Analysis

In analyzing the sectoral composition of the BSE Small Cap Index and the S&P 500, we can gain insights into the key sectors driving growth in each index and understand how sectoral performance may impact the overall growth of the indexes in 2025.

BSE Small Cap Index

The BSE Small Cap Index consists of a diverse range of sectors, including but not limited to manufacturing, consumer goods, financial services, healthcare, and technology. The small-cap companies in these sectors often exhibit higher growth potential compared to their large-cap counterparts due to their agility and innovative capabilities.

- Manufacturing: Small-cap manufacturing companies in India play a crucial role in driving economic growth through production and exports. These companies are influenced by factors such as raw material costs, demand trends, and government policies.

- Consumer Goods: The consumer goods sector in the BSE Small Cap Index includes companies that cater to the domestic market with products ranging from FMCG to durable goods. Consumer sentiment, purchasing power, and market competition impact the growth of these companies.

- Financial Services: Small-cap financial services firms provide a wide range of services such as banking, insurance, and asset management. Factors like interest rates, regulatory changes, and market volatility affect their performance.

S&P 500

The S&P 500 comprises sectors such as technology, healthcare, consumer discretionary, financials, and industrials. These sectors have a significant impact on the overall performance of the index, reflecting the broader U.S. economy's health and trends.

- Technology: The technology sector in the S&P 500 includes companies involved in software development, semiconductors, and internet services. Innovation, global demand, and regulatory changes influence the growth trajectory of tech companies.

- Healthcare: Healthcare companies in the S&P 500 encompass pharmaceuticals, biotechnology, and healthcare services. Factors like drug approvals, research breakthroughs, and healthcare policies drive the performance of these companies.

- Consumer Discretionary: Companies in this sector offer non-essential goods and services like retail, entertainment, and leisure. Consumer spending patterns, economic conditions, and trends impact the growth of these companies.

Sectoral performance plays a crucial role in determining the overall growth of the BSE Small Cap Index and the S&P 500 in 2025. By closely monitoring the sectors driving growth and understanding the factors influencing their performance, investors can make informed decisions to capitalize on opportunities and mitigate risks in their investment portfolios.

Concluding Remarks

In conclusion, the comparison between the BSE Small Cap Index and the S&P 500 in 2025 unveils a tapestry of growth potentials and market dynamics that are crucial for understanding the financial landscape. By examining historical performances, market dynamics, and sectoral analyses, investors can glean valuable information to navigate the complexities of the market with confidence and foresight.

Clarifying Questions

What are the key factors to consider when comparing the growth of BSE Small Cap Index and S&P 500 in 2025?

Key factors include market trends, economic indicators, sectoral performances, and company-specific data.

How do market dynamics impact the growth of small-cap companies in the BSE Small Cap Index?

Market dynamics such as investor sentiment, regulatory changes, and industry trends can significantly influence the growth of small-cap companies in the index.

Which sectors are driving growth in the S&P 500 and BSE Small Cap Index?

Technology, healthcare, and consumer discretionary sectors are notable drivers of growth in both indices.