Business Line of Credit for Startups: What to Know

Embarking on the journey of understanding Business Line of Credit for Startups: What to Know, readers are invited to explore a realm of financial possibilities tailored specifically for emerging businesses.

Delving deeper into the intricacies of startup financing, this article aims to equip entrepreneurs with the knowledge needed to navigate the complexities of obtaining and managing a line of credit.

Introduction to Business Line of Credit for Startups

When starting a new business, securing funding is crucial for growth and stability. One popular option for startups is a business line of credit, which offers flexibility and convenience compared to traditional loans.

What is a Business Line of Credit?

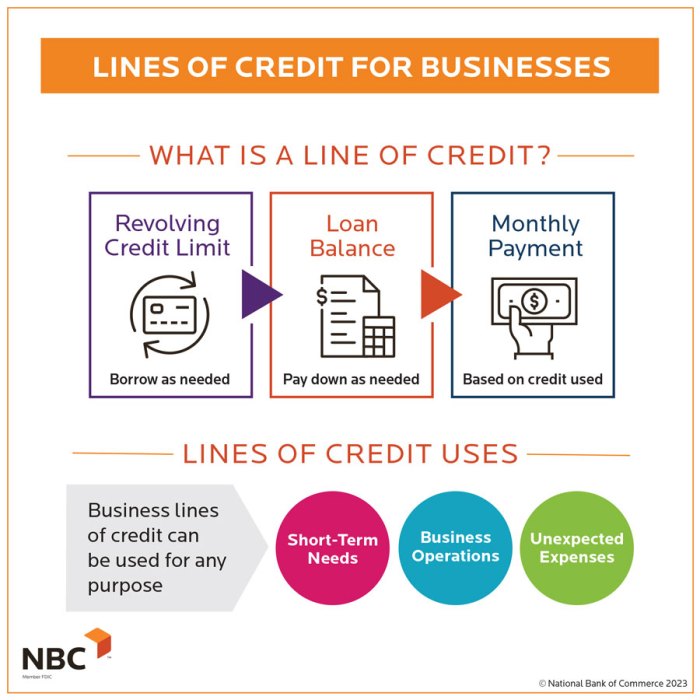

A business line of credit is a type of financing that provides a predetermined amount of money that a startup can borrow from on an as-needed basis. Unlike a traditional loan where you receive a lump sum upfront, a line of credit allows you to access funds when necessary, up to a specified limit.

Benefits of a Line of Credit for Startups

- Flexibility: Startups often experience fluctuating cash flow, making a line of credit a more adaptable financing option compared to a fixed loan amount.

- Cost-Effective: You only pay interest on the amount you use, rather than the entire credit limit, making it a cost-effective solution for startups.

- Build Credit: Responsible use of a line of credit can help startups establish and build their business credit profile, which is essential for future financing needs.

Importance of Having Access to a Line of Credit

For startups, having access to a line of credit can provide a safety net during lean times or unexpected expenses. It can help bridge gaps in cash flow, cover operational costs, and seize growth opportunities without the need for a lengthy approval process.

Qualifying for a Business Line of Credit

When it comes to startups seeking a business line of credit, there are certain requirements that they need to meet in order to qualify for this financial product. Lenders carefully evaluate various factors to determine a startup's eligibility for a line of credit, with a strong emphasis on the startup's credit score.

Typical Requirements for Startups

Startups looking to secure a business line of credit typically need to meet certain criteria to qualify for this type of financing. Some common requirements for startups may include:

- A solid business plan outlining the startup's goals, strategies, and financial projections.

- Evidence of a positive cash flow or a clear plan to achieve profitability in the near future.

- Proof of business registration and compliance with all legal requirements.

Factors Considered by Lenders

Lenders consider several key factors when evaluating a startup's eligibility for a business line of credit. These factors may include:

- The startup's credit history and credit score, which provide insight into the startup's ability to manage debt and repay borrowed funds.

- The startup's revenue and financial performance, including profitability and growth potential.

- The startup's industry, market conditions, and competition, which can impact the startup's ability to generate revenue and repay the line of credit.

Importance of Credit Score

A startup's credit score plays a crucial role in securing a business line of credit. A strong credit score demonstrates to lenders that the startup is a reliable borrower who is likely to repay the borrowed funds on time

Understanding How Business Lines of Credit Work

Business lines of credit are a flexible form of financing that allow startups to access a predetermined amount of funds from a financial institution. Unlike traditional loans, business lines of credit provide business owners with the ability to borrow funds as needed, up to a certain credit limit, and only pay interest on the amount borrowed.

Secured vs. Unsecured Lines of Credit

Secured lines of credit require collateral, such as business assets or personal guarantees, to back the credit line. This reduces the risk for the lender, making it easier for startups to qualify for a higher credit limit or better interest rates.

On the other hand, unsecured lines of credit do not require collateral, but may have stricter qualification requirements and higher interest rates.

Utilizing a Line of Credit for Business Operations

- Managing Cash Flow: Startups can use a line of credit to cover short-term expenses, manage fluctuations in cash flow, and bridge the gap between income and expenses.

- Purchasing Inventory: A line of credit can be used to purchase inventory in bulk, take advantage of discounts from suppliers, and meet customer demand without disrupting cash flow.

- Investing in Growth: Startups can utilize a line of credit to invest in marketing campaigns, expand their operations, hire new employees, or upgrade equipment to support business growth.

Managing and Repaying a Business Line of Credit

Effective management and timely repayment of a business line of credit are crucial for the financial health of startups. By following the right strategies, startups can avoid common pitfalls and maintain a good relationship with their lender.

Importance of Timely Payments

Timely payments are essential for startups to build trust with their lender and maintain a positive credit history. Late payments can lead to penalties, increased interest rates, and damage to the business's credit score.

Tips for Responsible Repayment

- Set up automatic payments to ensure that you never miss a due date.

- Create a repayment plan that fits your cash flow and budget to avoid financial strain.

- Avoid borrowing more than you can afford to repay to prevent accumulating excessive debt.

- Communicate with your lender if you anticipate any challenges in making payments to explore possible solutions.

Final Conclusion

As we conclude this insightful discussion on Business Line of Credit for Startups: What to Know, it becomes evident that access to financial resources can significantly impact the success and growth of a startup. Armed with the right information, entrepreneurs can confidently steer their businesses towards prosperity and sustainability.

FAQ

What are the typical requirements for startups to qualify for a business line of credit?

Startups usually need to demonstrate a strong business plan, revenue projections, and a good credit history to qualify for a business line of credit.

How do secured and unsecured lines of credit differ for startups?

A secured line of credit requires collateral, while an unsecured line does not. Secured lines usually have lower interest rates but involve more risk for the borrower.

What are some strategies for startups to effectively manage their line of credit?

Startups can manage their line of credit by keeping track of spending, making timely payments, and avoiding maxing out their credit limit to maintain a good relationship with the lender.