Business Line of Credit for Bad Credit: Is It Possible?

Business Line of Credit for Bad Credit: Is It Possible? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Exploring the nuances of obtaining a business line of credit with bad credit opens up a world of possibilities and challenges. Let's dive into this intriguing topic and uncover the key insights that can make a difference for businesses in need of financial support.

Introduction to Business Line of Credit for Bad Credit

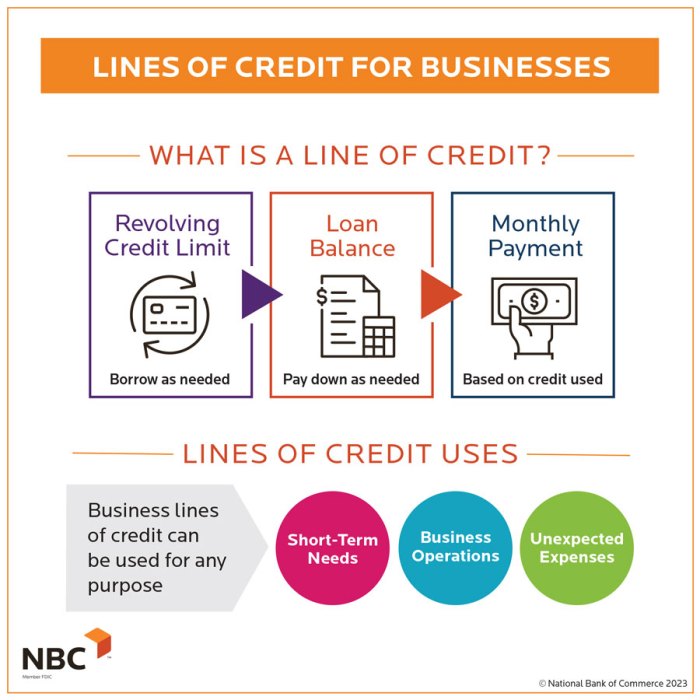

Business line of credit is a flexible financing option that allows businesses to access funds up to a predetermined limit. It works similar to a credit card, where you can borrow and repay funds as needed, but with lower interest rates.

Understanding Bad Credit in Business Financing

Bad credit in the context of business financing refers to a low credit score or a history of late payments, defaults, or bankruptcies. Lenders use credit scores to assess the creditworthiness of a business and determine the risk of lending money.

Challenges Faced by Businesses with Bad Credit

- Higher Interest Rates: Lenders may charge higher interest rates to offset the risk of lending to businesses with bad credit.

- Limited Access to Funds: Businesses with bad credit may have difficulty accessing the amount of credit they need.

- Stricter Requirements: Lenders may impose stricter requirements, such as collateral or personal guarantees, for businesses with bad credit.

Factors Considered by Lenders for Approval

- Credit Score: The credit score of the business and its owners is a crucial factor in determining eligibility for a line of credit.

- Business Performance: Lenders may review the financial performance and stability of the business to assess its ability to repay the credit line.

- Cash Flow: Positive cash flow and consistent revenue can increase the chances of approval for a line of credit.

Options for Obtaining a Business Line of Credit with Bad Credit

When it comes to securing a business line of credit with bad credit, there are alternative financing options available for businesses in need. It's essential to explore these options to find the best fit for your company's financial needs.

Traditional Banks vs. Online Lenders

- Traditional banks often have strict credit requirements, making it challenging for businesses with bad credit to qualify for a line of credit.

- Online lenders, on the other hand, may be more flexible and willing to work with businesses with less-than-perfect credit scores.

- Consider the interest rates, terms, and fees associated with both traditional banks and online lenders to make an informed decision.

Building a Strong Business Case

- When applying for a business line of credit with bad credit, it's crucial to build a strong business case to demonstrate the viability of your company.

- Provide detailed financial statements, business plans, and projections to show lenders that your business is capable of repaying the line of credit.

- Highlight any positive aspects of your business, such as strong cash flow or a loyal customer base, to strengthen your case.

Improving Credit Score

- One way to increase your chances of approval for a business line of credit is to work on improving your credit score.

- Make timely payments on existing debts, reduce credit utilization, and dispute any errors on your credit report to boost your score.

- Consider working with a credit repair specialist or financial advisor to develop a plan for improving your credit over time.

Strategies for Managing a Business Line of Credit with Bad Credit

Managing a business line of credit with bad credit requires careful planning and financial discipline to ensure the success and sustainability of your business. Here are some strategies to help you navigate this challenging situation:

Best Practices for Responsibly Using a Business Line of Credit with Bad Credit

- Monitor your credit utilization ratio to keep it below 30% to avoid negatively impacting your credit score.

- Make timely payments to build a positive payment history and improve your creditworthiness over time.

- Avoid maxing out your credit limit, as it can signal financial distress to lenders and harm your credit profile.

- Create a budget and stick to it to ensure that you can repay the borrowed funds on time.

Implications of Missing Payments or Defaulting on a Line of Credit for Businesses with Bad Credit

Missing payments or defaulting on a line of credit can have severe consequences for your business, including:

- Damage to your credit score, making it harder to secure financing in the future.

- Potential legal action from the lender, leading to additional financial burdens and restrictions.

- Limited access to credit options and higher interest rates due to the increased risk associated with your business.

Guidance on Effectively Managing Cash Flow when Utilizing a Line of Credit with Bad Credit

To effectively manage cash flow when using a line of credit with bad credit, consider the following tips:

- Track your expenses and revenue to understand your cash flow patterns and make informed decisions.

- Use your line of credit for short-term financing needs and avoid relying on it for long-term operational expenses.

- Negotiate favorable terms with your suppliers and customers to optimize cash flow and reduce the need for constant borrowing.

Examples of Successful Businesses Managing a Line of Credit despite Having Bad Credit

While challenging, some businesses have successfully managed a line of credit with bad credit by implementing sound financial practices and strategic planning. One such example is XYZ Company, which improved its credit score by making consistent payments and utilizing its line of credit for growth opportunities rather than daily operations.

Benefits and Risks of Business Line of Credit for Bad Credit

When it comes to obtaining a business line of credit with bad credit, there are both advantages and risks involved. Let's explore the potential benefits and pitfalls of this financial option.

Potential Advantages of Obtaining a Line of Credit for Businesses with Bad Credit

- Access to Funding: Despite having bad credit, businesses can still access much-needed funds through a line of credit, allowing them to cover expenses, manage cash flow, and invest in growth opportunities.

- Improving Credit Score: By responsibly using a business line of credit and making timely payments, businesses have the chance to improve their credit score over time, opening up more financial opportunities in the future.

Risks Associated with Utilizing a Line of Credit with Bad Credit

- Higher Interest Rates: Lenders may charge higher interest rates for businesses with bad credit, increasing the overall cost of borrowing and potentially impacting profitability.

- Strain on Cash Flow: If not managed properly, utilizing a line of credit can put a strain on the business's cash flow, leading to difficulties in repaying the borrowed funds.

Comparison of Interest Rates and Terms Offered by Different Lenders

- Interest Rates: Different lenders may offer varying interest rates for business lines of credit with bad credit, so it's essential for businesses to compare options and choose the most favorable terms.

- Terms and Conditions: Understanding the terms and conditions of the line of credit is crucial, as they can impact the overall cost and repayment structure of the borrowed funds.

Leveraging a Line of Credit to Improve Credit Score Over Time

- Timely Payments: Making timely payments on the line of credit can positively impact the business's credit score, showcasing financial responsibility to lenders.

- Responsible Borrowing: By borrowing only what is necessary and managing the line of credit effectively, businesses can gradually improve their creditworthiness and access better financial products in the future.

Final Summary

As we conclude our discussion on Business Line of Credit for Bad Credit: Is It Possible?, it becomes evident that despite the hurdles, there are viable solutions and strategies available for businesses to navigate the realm of credit with confidence.

By understanding the nuances and implications, businesses can make informed decisions to propel their financial growth and stability.

FAQ

Can businesses with bad credit still qualify for a line of credit?

Yes, it is possible for businesses with bad credit to qualify for a line of credit, but they may face higher interest rates or stricter terms.

What are some alternative financing options for businesses with bad credit?

Alternative options include merchant cash advances, invoice financing, or peer-to-peer lending.

How can businesses improve their credit score to increase chances of approval?

Businesses can improve their credit score by making timely payments, reducing debt, and monitoring their credit report regularly.

What are the risks associated with utilizing a line of credit with bad credit?

Risks include higher interest rates, potential for default, and negative impacts on credit score if not managed responsibly.