How Global Events Are Shaping Westpacs ASX Position: A Comprehensive Analysis

Exploring the intricate relationship between global events and Westpac's ASX position, this article delves into the various factors that influence the bank's performance on the stock market. With a focus on recent developments and their impact, readers are invited to uncover the dynamic nature of this financial landscape.

From economic factors to geopolitical events and technological advancements, the following sections will provide a detailed examination of how these elements shape Westpac's ASX position.

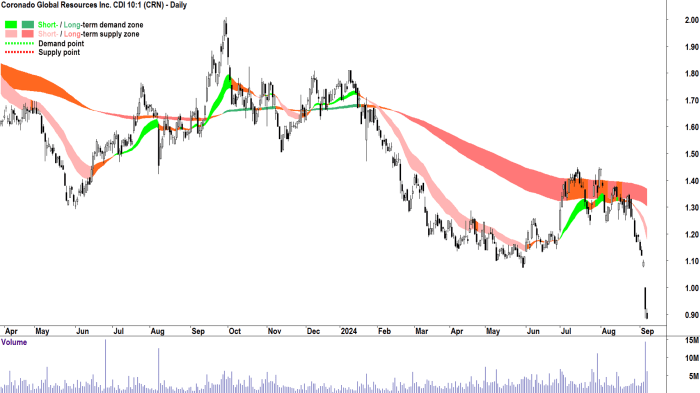

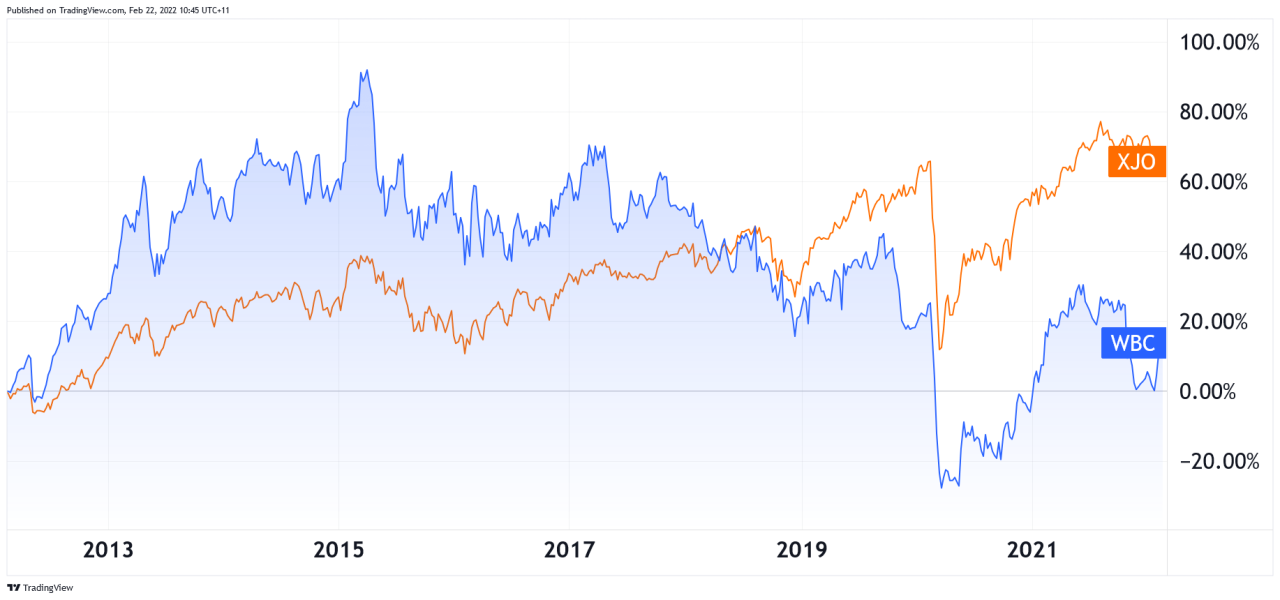

Overview of Westpac's ASX Position

Westpac Banking Corporation (Westpac) is one of the "Big Four" banks in Australia and is listed on the Australian Securities Exchange (ASX) under the ticker symbol WBC. As of [current date], Westpac holds a prominent position on the ASX and is considered a key player in the Australian financial market.Global events have a significant impact on Westpac's ASX position, as the bank operates in a globalized economy where economic, political, and social events from around the world can affect its performance.

These events can influence investor sentiment, market volatility, interest rates, and regulatory changes, all of which play a role in shaping Westpac's ASX position.

Recent Global Events Influencing Westpac's ASX Performance

- The COVID-19 Pandemic: The outbreak of the COVID-19 pandemic in 2020 led to economic uncertainty, market volatility, and changes in consumer behavior. Westpac, like other banks, had to navigate through the challenges posed by the pandemic, such as loan deferrals, lower interest rates, and increased provisions for bad debts.

- US-China Trade War: Tensions between the United States and China have had ripple effects across global markets, including the Australian financial sector. Westpac's ASX position can be impacted by trade negotiations, tariffs, and shifts in supply chains resulting from the trade war.

- Interest Rate Changes: Central bank decisions regarding interest rates can impact Westpac's profitability and lending practices. Changes in interest rates by the Reserve Bank of Australia or other global central banks can affect Westpac's net interest margin and overall financial performance.

Impact of Economic Factors

Economic factors such as interest rates, inflation, and GDP growth play a significant role in shaping Westpac's ASX position. These factors can directly affect the bank's profitability, market sentiment, and overall performance.

Interest Rates

Interest rates set by central banks have a direct impact on Westpac's ASX position. When interest rates are low, borrowing becomes cheaper, leading to increased consumer spending and investment. This can positively influence Westpac's stock performance as the bank sees higher demand for loans and financial products.

Inflation

Inflation refers to the increase in the prices of goods and services over time. High inflation can erode the purchasing power of consumers, leading to reduced spending and investment. This can negatively impact Westpac's ASX position as the bank may face lower demand for loans and financial services.

GDP Growth

GDP growth indicates the health of the economy and can impact Westpac's ASX position. Strong GDP growth usually translates to higher consumer confidence, increased investment, and overall economic stability. This can have a positive effect on Westpac's stock performance as the bank benefits from a growing economy.

Economic Policies

Changes in economic policies, such as fiscal and monetary measures, can influence Westpac's ASX position. For example, government stimulus packages or regulatory changes can impact the bank's operations and profitability

Geopolitical Events and Westpac's ASX Position

Geopolitical events such as trade wars and political instability can have a significant impact on Westpac's ASX performance. These events can create uncertainty in the market, leading to fluctuations in Westpac's stock price.

Impact of Geopolitical Tensions on Westpac's Stock Price

Geopolitical tensions, such as trade disputes between major economies, can result in market volatility. This volatility can affect investor sentiment towards Westpac, causing its stock price to fluctuate. For example, heightened tensions between trading partners can lead to concerns about the bank's exposure to specific markets, impacting its ASX position.

Comparison of Different Geopolitical Events on Westpac's ASX Position

Different geopolitical events can have varying effects on Westpac's ASX position. For instance, political instability in a key market where Westpac operates can lead to concerns about the bank's operations and profitability, impacting its stock price. On the other hand, trade negotiations that result in favorable outcomes for the bank can boost investor confidence and drive up its stock price.

Technological Advancements and Westpac's ASX Position

Technological advancements play a crucial role in shaping Westpac's ASX position, influencing its competitiveness and overall performance in the stock market. The ability to adapt to and leverage new technologies such as fintech innovations and digital banking trends is essential for Westpac to stay relevant and meet the evolving needs of customers and investors.

Impact of Fintech Innovations

Fintech innovations have revolutionized the financial industry, introducing new ways of conducting transactions, managing investments, and accessing banking services. Westpac's ability to integrate these innovations into its operations can enhance efficiency, customer experience, and ultimately impact its ASX position positively.

- Utilizing blockchain technology for secure and transparent transactions.

- Implementing AI-powered chatbots for customer service and support.

- Offering mobile payment solutions to cater to the increasing demand for digital transactions.

Digital Banking Trends and Westpac's ASX Performance

The shift towards digital banking has transformed the way customers interact with financial institutions, emphasizing convenience, speed, and personalized services. Westpac's commitment to digital transformation can significantly influence its ASX performance by attracting tech-savvy investors and maintaining a competitive edge in the market.

- Enhancing online banking platforms for seamless user experience.

- Investing in cybersecurity measures to protect customer data and financial assets.

- Introducing innovative digital payment solutions to meet changing consumer preferences.

Final Thoughts

In conclusion, the ever-evolving landscape of global events continues to play a crucial role in determining Westpac's ASX position. By understanding the complexities and interconnections at play, investors and analysts alike can make more informed decisions in navigating the stock market.

Common Queries

How do global events impact Westpac's ASX position?

Global events can influence Westpac's ASX position through various channels such as market sentiment, regulatory changes, and economic shifts.

What are some recent global events that have affected Westpac's ASX performance?

Events like trade tensions between major economies, fluctuations in currency exchange rates, and changes in central bank policies have all had an impact on Westpac's ASX performance.

Why is it important to consider technological advancements when analyzing Westpac's ASX position?

Technological advancements play a significant role in shaping the competitive landscape for banks like Westpac, influencing factors such as digital banking trends and fintech innovations.