Westpac ASX vs. SEA Stock: Which One Is a Better Long-Term Bet?

Starting off with the comparison between Westpac ASX and SEA Stock, this article aims to delve into which stock presents a more promising long-term investment opportunity, drawing readers in with a mix of informative insights and engaging language.

The following paragraph will provide a detailed overview of the topic, shedding light on the key aspects that differentiate these two stocks.

Introduction to Westpac ASX and SEA Stock

Westpac ASX refers to Westpac Banking Corporation, a prominent Australian bank listed on the Australian Securities Exchange (ASX). On the other hand, SEA Stock represents Sea Limited, a leading technology company in Southeast Asia listed on various stock exchanges.Investing in these stocks holds significant importance for investors looking to diversify their portfolio and capitalize on the growth potential of the financial and technology sectors.

Westpac ASX offers exposure to the stability of the banking industry in Australia, while SEA Stock provides an opportunity to tap into the fast-growing digital economy in Southeast Asia.The differences between Westpac ASX and SEA Stock lie in their respective industries, geographical focus, growth prospects, and risk profiles.

Westpac ASX operates in the traditional banking sector, which is known for its stability but limited growth potential compared to the dynamic tech industry represented by SEA Stock. Investors need to consider these factors carefully when deciding which stock is a better long-term bet for their investment goals.

Historical Performance

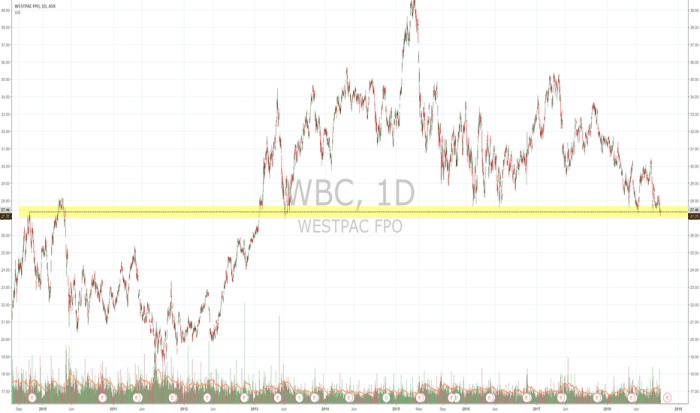

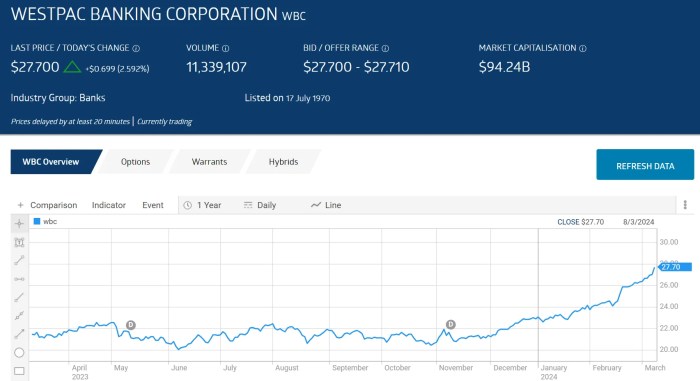

When comparing the historical performance of Westpac ASX and SEA Stock, it is important to analyze the trends and patterns seen in their performance over time to make an informed decision on which one is a better long-term bet. Let's delve into the details to understand how each has fared over the years.

Westpac ASX

Westpac Banking Corporation, listed on the Australian Securities Exchange (ASX), has a long-standing history in the financial sector. Over the years, Westpac has shown resilience in navigating through various economic cycles. However, the bank has also faced challenges, such as regulatory changes, economic downturns, and shifts in consumer behavior.

It is essential to consider these factors when assessing the historical performance of Westpac ASX.

SEA Stock

SEA Limited, traded on the stock market under the symbol SEA, has experienced rapid growth in recent years. As a leading technology company in Southeast Asia, SEA has benefited from the region's increasing digital adoption and e-commerce trends. The stock's performance has been influenced by the company's expansion strategies, product innovations, and market competition.

Understanding these dynamics is crucial in evaluating the historical performance of SEA Stock.

Financial Health Assessment

When considering long-term investments in stocks, assessing the financial health of the companies is crucial to make informed decisions. Let's delve into the financial stability of Westpac ASX and SEA Stock by examining key financial metrics such as revenue, profit margins, and debt-to-equity ratios.

Westpac ASX

- Revenue: Westpac ASX has consistently generated substantial revenue over the years, showcasing its strong market presence.

- Profit Margins: The profit margins of Westpac ASX have been relatively stable, indicating efficient cost management and profitability.

- Debt-to-Equity Ratio: The debt-to-equity ratio of Westpac ASX is within an acceptable range, reflecting a balanced capital structure.

SEA Stock

- Revenue: SEA Stock has experienced impressive revenue growth, demonstrating its potential for future expansion and market share.

- Profit Margins: The profit margins of SEA Stock have shown improvement, suggesting operational efficiency and profitability.

- Debt-to-Equity Ratio: SEA Stock maintains a conservative debt-to-equity ratio, indicating prudent financial management and lower financial risk.

In comparison, both Westpac ASX and SEA Stock exhibit strong financial health, but with differences in their financial metrics. Investors should consider these factors along with their investment goals and risk tolerance when evaluating which stock may be a better long-term bet.

Market Positioning and Growth Prospects

When it comes to market positioning and growth prospects, both Westpac ASX and SEA Stock have unique positions within their respective industries. Let's delve deeper into their strategies and potential challenges.

Westpac ASX: Market Positioning and Growth Prospects

Westpac ASX, as one of the leading banks in Australia, has a strong market presence and brand recognition. With a focus on providing a wide range of financial services to customers, Westpac has positioned itself as a trusted institution in the banking sector.

In terms of growth prospects, Westpac is constantly innovating and investing in technology to enhance customer experience and streamline operations. However, the bank may face challenges such as regulatory changes and increasing competition in the financial industry.

SEA Stock: Market Positioning and Growth Prospects

SEA Stock, a prominent player in the Southeast Asian e-commerce and gaming markets, holds a significant market share in the region

The company's growth prospects are promising, especially with its expansion into new markets and the introduction of innovative products. Nevertheless, SEA Stock may encounter challenges related to regulatory issues in different countries and competition from other e-commerce and gaming companies.

Strategic Initiatives and Partnerships

Both Westpac ASX and SEA Stock have been proactive in forming strategic partnerships and initiatives to drive their future growth. For instance, Westpac has collaborated with fintech companies to improve its digital offerings and expand its customer base. On the other hand, SEA Stock has entered into partnerships with major gaming developers to enhance its gaming platform and attract more users.

These strategic moves not only strengthen their market positions but also pave the way for sustainable growth in the long run.

Risk Analysis

Investing in Westpac ASX and SEA Stock involves certain risks that potential investors should consider before making any decisions. Let's delve into the key risks associated with each stock and provide recommendations on risk management strategies.

Westpac ASX

- Market Risk: Westpac ASX is susceptible to market fluctuations which can impact the stock price. Economic conditions, interest rates, and geopolitical events can all influence the performance of the stock.

- Regulatory Risk: Being a financial institution, Westpac ASX is subject to regulatory changes and compliance requirements. Any new regulations or legal issues could affect the company's operations and profitability.

- Credit Risk: As a bank, Westpac ASX faces credit risk from loans and investments. Any increase in loan defaults or economic downturns can lead to financial losses for the company.

Recommendation: Potential investors in Westpac ASX should diversify their investment portfolio to reduce market risk exposure. Monitoring regulatory changes and conducting thorough credit analysis can help mitigate risks associated with regulatory and credit risk.

SEA Stock

- Competition Risk: SEA Stock operates in the highly competitive tech industry, facing competition from established players and new entrants. Any failure to innovate or keep up with market trends could impact the stock price.

- Technology Risk: Being a tech company, SEA Stock is exposed to rapid technological advancements and disruptions. Failure to adapt to new technologies or changes in consumer preferences can pose a risk to the company's growth prospects.

- Political Risk: SEA Stock operates in multiple countries with varying political landscapes. Political instability, regulatory changes, or trade disputes can affect the company's operations and profitability.

Recommendation: Investors considering SEA Stock should stay informed about the competitive landscape and industry trends. Conducting regular technology assessments and staying updated on political developments in key markets can help manage risks associated with competition, technology, and political factors.

Sustainability and ESG Factors

When it comes to evaluating the long-term prospects of Westpac ASX and SEA Stock, considering their sustainability practices and ESG factors is crucial. These factors not only impact the environment and society but also play a significant role in shaping the overall performance and reputation of companies.

Westpac ASX Sustainability and ESG Analysis

- Westpac ASX has been actively involved in sustainability initiatives, including reducing carbon emissions, promoting diversity and inclusion, and supporting community development projects.

- The bank has implemented robust governance practices, ensuring transparency and accountability in its operations.

- Westpac ASX's alignment with ESG criteria has helped strengthen its brand image and attract socially responsible investors.

SEA Stock Sustainability and ESG Analysis

- SEA Stock has focused on sustainable business practices, such as reducing waste, promoting renewable energy, and supporting ethical sourcing.

- The company has taken steps to enhance social welfare, including investing in employee well-being and community engagement programs.

- SEA Stock's commitment to good governance principles has contributed to its positive reputation and stakeholder trust.

Final Review

In conclusion, this discussion encapsulates the essential points of comparison between Westpac ASX and SEA Stock, offering readers a comprehensive understanding of the factors to consider when making a long-term investment decision.

FAQ Guide

Which stock is more suitable for long-term investment, Westpac ASX or SEA Stock?

Each stock has its advantages and risks, so it's crucial to conduct thorough research and consider your investment goals before making a decision.

What are the key financial metrics to look at when comparing Westpac ASX and SEA Stock?

Important metrics include revenue growth, profit margins, and debt-to-equity ratios, which can provide insights into the financial health of these stocks.

How do sustainability practices impact the long-term prospects of Westpac ASX and SEA Stock?

Sustainability practices can influence investor perception and long-term viability, making it important for companies to align with ESG criteria.